Introduction

When businesses are managed on a global scale, it becomes challenging to manage different currencies and analyze currency data, making a scalable solution necessary. Changes in the exchange rate can lead to financial losses and mistakes. Developers struggle to locate accurate and timely data sources. Selecting an incorrect API can result in errors and a suboptimal customer experience.

The issue can be solved by using a trustworthy currency API that also supports commercial use. It also has real-time exchange rates and historical rates that are accurate and secure. The appropriate API enables seamless financial operations, while also ensuring regulatory compliance. It also improves the speed and decision-making of your business.

This blog provides all the information you need to know about selecting the right currency exchange. You will also understand how these APIs operate, their key characteristics, and what to consider before selecting one. It also lists the best free APIs for developers.

If you're looking for a reliable option, CurrencyFreaks is one of the top APIs trusted by developers for accurate exchange data, offering effortless integration. Let's get started with the best currency rate API.

What Is An API For Currency Exchange?

The Currency Exchange API, a type of currency data API, allows your software program to retrieve and read currency rate information automatically. This includes both the current live data and past foreign exchange (forex) rates. The API is a secure, open system connection. It simply connects your system to a large group of financial data sources for quick implementation.

Learn more about the best web service for currency conversion and how it can simplify your process.

How Does An API for Currency Exchange Work?

The following are the steps involved in the working of an API for Currency Exchange:

-

Essentially, the rule used is HTTP.

-

The application makes a structured GET request to an API endpoint URL.

-

This request includes your API key for authentication purposes. It also includes parameters. The names of these parameters are the target and base currency.

-

The API server will get the most recent data. It gets this data through its trusted upstream sources. Then, it processes the data and sends a response back.

-

This data is commonly in a standard, readable format, such as JSON or XML. Therefore, the data can be easily used in any modern programming language.

Types and Categories of Exchange Rate Data

The APIs provide different types of exchange data. You must decide which type to use in your specific application:

-

Spot Rates (Latest Rates): Rates are the real-time rates. You need them to perform live conversions, e-commerce checkouts, and transactions on trading platforms.

-

Historical Rates: These are rates from the past. For example, you use them in accounting, financial reconciliation, and back-testing strategies.

-

Time Series Data: It is a collection of daily rates within a given range. That is why it is of great value in trend analysis and advanced reporting.

-

Fluctuation Data: This shows the change and percentage change between an end date and a start date. You get it on particular currency pairs. It helps in measuring volatility and performance.

-

Conversion Endpoints: These help you to provide a from currency, a to currency, and an amount. The API gives the calculated value in terms of conversion. This simplifies your client-side logic.

Why Does Choosing The Right API For Currency Exchange Matter?

A correct API is more than just a simple data feed. It is a key part of your financial system that is absolutely necessary. Making a wrong choice can result in high costs, including mistakes, bad publicity, hidden fees, and additional expenses.

Direct Financial Impact

Settlement risk and slippage are results of wrong or late rates. In systems that handle a large number of transactions, even a small difference in the exchange rate can result in significant financial losses over time. You need to be careful to protect your profits.

Scalability and Performance

The speed of your application is directly related to the speed of the API, particularly when it comes to providing an hourly updates option. Latency is created by slow API response times. This frustrates your users. It affects the sales rate in e-commerce.

A good API can be built with the help of Content Delivery Networks (CDNs) and geolocation-based routing. This guarantees low latency. The average global latency typically ranges from 20 to 40 ms.

Regulatory And Audit Requirements

Financial institutions and companies operating globally face stringent regulations. You must have a clear and verified record. This trail keeps a record of the rates charged on each transaction involving worldwide currencies.

A trustworthy API also ensures a clear data source, guaranteed availability, historical exchange rates, timestamping, and access to past data. This meets your compliance requirements.

Key Features To Consider For Choosing An API For Currency Exchange Rate Data

When selecting a provider, you need to evaluate the key technical and operational factors. You must not compromise on these non-functional needs.

Accuracy and Reliability

Accuracy is essential. It is the result of the data source. The best intuitive APIs utilize a variety of reliable, firsthand sources of data, including accurate foreign exchange rates. These providers include major foreign exchange (forex) exchanges, central banks, the European Central Bank, and specialty financial data providers.

They use advanced validation algorithms. They identify suspicious or incorrect rates before they are entered into your system.

Real-Time Data Updates

State your required update speed. Standard updates can occur as slowly as every hour and as quickly as every 60 seconds. Enterprise-grade solutions can be implemented in under a second. The 24-hour update cycle is no longer suitable for modern financial or e-commerce processes. As such, you need Live rates (renewed in a minute or less). You require them for real-time pricing and trading applications.

Historical Data Access

Check the historical data of the API. This becomes essential in yearly reporting, tax filings, and market analysis. High-quality providers provide information that shows the situation over several decades. This typically dates back to the 1980s or earlier. This involves the ability to query rates of a given date or a given range of time series.

Security and Compliance

Data security is most important. This is particularly in the manner in which financial information is handled.

Data Encryption

Any API communication should be encrypted. Demand that providers use the encryption system (SSL/TLS) on all API requests. They ought to do that regardless of your level of subscription. This helps safeguard the data passed between your server and theirs.

Regulatory Compliance

Know your industry and geographical law. The API provider should ensure that you comply with the applicable regulations. Search for qualities that help in auditable data records and rate provenance.

User Authentication

The default authentication system is the API Key. Always use this key securely. Do not hard-code your API key into client-side applications (such as JavaScript). This action reveals your key. It causes unauthorized access and possible overruns of the rate limit. Ensure that the API features straightforward key management through a dedicated dashboard.

For more in-depth guidance on APIs for currency conversion, see the best web service for currency conversion and the Exchange Rate API Integration with Svelte JS.

Integration and Compatibility

An effective API is useless when it cannot be easily set up.

API Documentation

Complete documentation is highly necessary. It should be able to give a clear description of endpoints, parameters, and error codes. Search for working code examples in various popular languages. These are Java, Python, PHP, Ruby, and JavaScript. This eventually saves a lot of time on integration.

Supported Platforms/Programming Languages

Its API is a language-neutral one. It communicates over HTTP. Nevertheless, decent providers provide pre-existing SDKs or libraries for popular frameworks. This shortens the development period. Its fundamental prerequisite is that the API will provide data in a standard format, e.g., JSON or XML.

Ease of Integration

Check the query structure complexity. RESTful endpoints are better, and they are simple. They allow filters to be easily used. The best systems tend to take a comma-separated symbols parameter. By doing so, you will reduce data transportation and enhance the efficiency of your calls. Learn more about the best web service for currency conversion and how it can simplify your process.

Pricing and Subscription Plans

The pricing model determines the total cost of ownership.

Know the scalable volume of requests you want in a month. Select a plan that includes a sufficient number of API calls. It should be able to manage peak load without paying an overage fee. Plans are free (e.g., 1,000 calls/month) for enterprise custom solutions. These solutions rely on volume-based pricing. Record the frequency of updates of each tier. Quicker updates often require a more comprehensive plan.

| Plan Name | Monthly Calls | Update Frequency | Key Features |

|---|---|---|---|

| Developer (Free) | 1,000 | 24 Hours | USD Base, SSL Encryption |

| Starter | 15K | Hourly | Historical Rates, All Bases |

| Growth | 150K | 10 Minutes | IP to Currency Endpoint |

| Professional | 550K | 60 Seconds | Time Series, Fluctuations Endpoints |

Customer Support And Resources

Timely platinum support is crucial. It will come in handy during troubleshooting integration problems or resolving data anomalies. Consider the support team systems that were provided. Search for social support, emails, and powerful contact forms.

Premium support is typically included with higher-tier plans. Further, verify the availability of a publicly visible API Status Page regarding uptime and performance.

Performance and Speed

Examine other measures than response time. Test the uptime guarantee made by the provider. An effective provider must have a near-perfect uptime. Seek such an amount as 100 percent in the past 90 days. You need to test the API with tools such as cURL to determine the API latency in your deployment area.

Customization and Flexibility

Most appropriate APIs are highly customizable. Key features include:

-

Changing the Base Currency: USD is the base currency. Nonetheless, the possibility of defining a specific currency (e.g., EUR, GBP) as the base is essential to a particular business logic.

-

IP-to-Currency Endpoint: This is also an important tool that automatically identifies the geographical location of a client based on their IP address. It offers the local currency rate. Therefore, this is good for regional user experiences.

-

Filtering Symbols: Only show the currency symbols you require. This significantly reduces payload size and processing time.

Reputation and Reviews

Examine the history of the provider. What are their established clients? What are their setups? Reliability is indicated by companies with major brands, trading apps, and universities. Find third-party reviews and recommendations by other engineers.

Legal and Licensing

Read the Terms of Service and the Privacy Policy. Be aware of the licensing conditions for the data you access. Ensure that you are free to use the data as needed by your application.

Future-Proofing and Scalability

Select a provider that actively continues and develops its service, and can accommodate product management feature requests. Do they accept several different currencies? Find the support of 170+ fiat currencies.

Search for different precious metals, premium features, and an expanding list of cryptocurrencies. Ultimately, this ensures that you can add features to your platform without the need for a painful transition to an API in the future.

Top Free Currency Exchange APIs

A free-tier API is a great starting point for developing, testing, or working on low-volume projects. Nevertheless, there is no level that is always free from limits. These limits will affect the frequency of updates, the base currency options, and the number of API calls.

CurrencyFreaks

CurrencyFreaks is a strong and complete currency exchange API. It's free plan supports 1,000 API calls every month with a daily refresh. It includes currencies, such as fiat, metals, and cryptocurrencies. The API provides secure data transfer via SSL encryption, making it a safe and reliable option among developers, supported by straightforward instructions.

Exchangerate.host

Exchangerate.host is a free, open-source exchange API. It is also community-based, and as a result, it is reliable and transparent. It has been well-liked among developers due to its easy installation and easy-to-read documentation.

The API is known to support various currencies and also offers real-time and historical rates, making it very suitable for testing and developing, as well as small-scale projects.

Currencylayer

Currencylayer is a reliable and reputable currency exchange API. It offers sound and true exchange rates. The free option provides access to the most up-to-date rates, suitable for small projects or tests. Premium plans offer additional capabilities, including historical support, real-time updates, and expanded currency coverage.

Open Exchange Rates

Open Exchange Rates is an API with a long-standing reputation for accuracy, thanks to its extensive historical data. It enables developers to utilize both previous and current exchange rates to analyze and report on them. The free plan, however, is very restricted and only provides basic features. Paid plans are more up-to-date, support more currencies, and offer advanced functionalities.

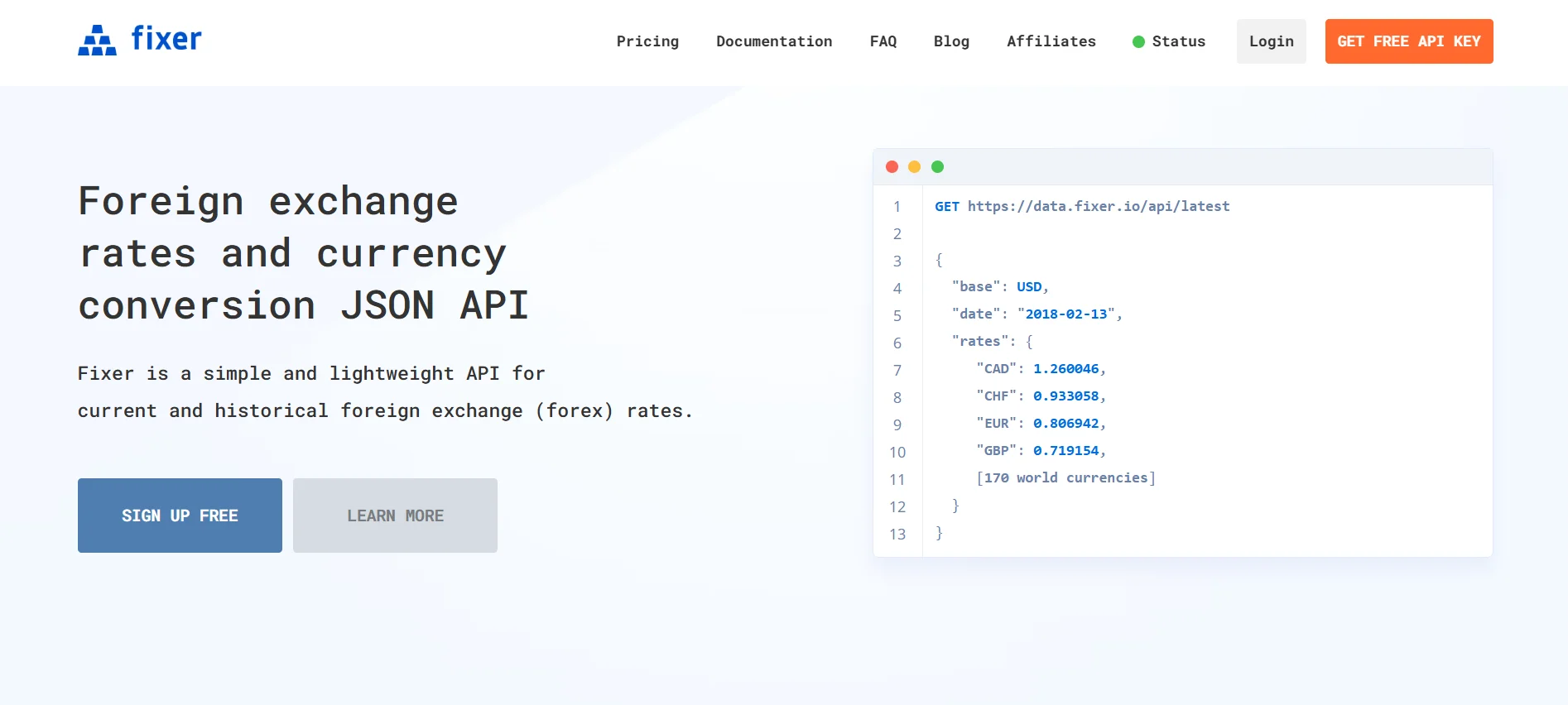

Fixer.io

Fixer.io is a reputable currency exchange API in the fintech industry. It provides quality and precise API for Currency Exchange information. The free plan is also largely Euro-based, meaning that it cannot be used with other currencies. Paid plans are extended, offer real-time updates, and include additional options for broader financial applications.

Conclusion

The choice of the right currency exchange API is crucial in any program that handles financial information. A good API with premium features will guarantee accurate rates, quick updates, secure information transfer, and accommodate limitless opportunities and feature requests. It lessens the financial risk and creates a smooth experience for your users. Determine your needs before selecting an API.

Consider factors such as the frequency of updates, coverage of various currencies, and historical data requirements. Verify the security of the provider, including the use of a secure API key and the presence of an encrypted method of transfer through the use of a common SSL key. Determine the ease of integration, documentation, and support.

The free plans are great for testing or when a project does not require a high volume; however, this does not mean that the paid plans do not offer real-time data, extensive coverage, and other valuable features. Explore options for customization, including the conversion of the base currency and filtering symbols. Lastly, look at future growth and scalability.

The chance to have a well-chosen and scalable API that will help you with your current needs and can adjust to your growing platform. Taking the time to choose the right API ensures accuracy, reliability, and long-term success.

FAQs

What Is An API for Currency Exchange?

It is a tool that provides both real-time and historical rates of exchange for currencies in machine-readable formats.

Why Is It Important To Have Accurate Data In An API for Currency Exchange?

Accurate data that is updated in milliseconds prevents financial losses, ensures accurate conversions, and facilitates compliance with accounting and government regulations.

Are There Any Free Exchange Rate APIs?

Yes, APIs such as CurrencyFreaks offer free plans that can be used for testing, small private projects, and even commercial use.

What Extra Features Should I Look For In An API for Currency Exchange?

Look for historical rates, time series information, currency codes, limits on price fluctuations, and IP-to-currency conversion tools.

How Important Is Security In An API for Currency Exchange?

Security is very important. Always ensure that you use HTTPS/SSL and do not display your API key to the frontend.

What Should I Check When Choosing An API for Currency Exchange?

How often it checks for updates, how many currencies it covers, whether it has historical data, whether it provides hourly updates, and how clear the API instructions are.

How Often Does The Exchange Rate Data Get Updated?

Free plans are updated daily, while paid plans are updated frequently (usually every 10 minutes, 60 seconds, or more).

Select the currencies you need and update your API by choosing the base currency.