Why Businesses Are Switching From the Google Currency Exchange Rate API to Better APIs

Introduction

You know pain when currency rates are not accurate. It is possible that your eCommerce store shows you the wrong product price. Maybe your fintech app delayed an update. This is causing confusion among the users. A lot of businesses face this real problem every day.

When you were in that condition, the Google Currency Exchange rate API felt like a simple fix. It was free, fast, and its integration is easy. Now things have changed. Today, developers want more accuracy, more endpoints, and more transparency. Finance-led teams demand real-time forex data, historical trends, and enterprise-level security. So Google currency exchange rate API does not keep up.

That’s why many businesses are now switching to modern currency APIs such as CurrencyFreaks. In this blog post, we will talk about what things are missing in Google’s API, why others perform better, and how you can switch smoothly. Let's get started.

The Limitations of the Google Currency Exchange Rate API

1. Lack of Real-Time Accuracy

The major problem is inconsistent updates. Currency Exchange Api Google does not properly refresh the foreign exchange rate in real-time exchange rates. You see that the rates are delayed by minutes or even hours. That’s a major problem if you run a trading platform, a global eCommerce store, or a fintech application. Your users need live numbers. Even a slight delay affects conversions and user trust.

2. No Compatibility With All FX Use Cases

Google offers very basic exchange rate data. You don’t get time series. You don’t get fluctuation data. You also don’t get deep historical coverage. There’s no native currency conversion endpoint either. As a result, developers must stitch together custom logic. That increases bugs and slows development.

If you want to learn about the best Currency Exchange Google API, then read this blog of CurrencyFreaks, 10 Best Currency Exchange API.

3. No Clear Pricing or Usage Transparency

Google never provides clear pricing for its exchange rate data. Many developers depend on unofficial endpoints or scraped outputs. This creates a serious reliability issue. You can’t predict costs. You can’t estimate usage. And you can’t build a long-term product based on unstable access.

4. No Dedicated Developer Support

When something breaks, you go to community forums. There’s no priority support. There’s no technical guidance. High-scale applications need reliable support channels, not guesswork.

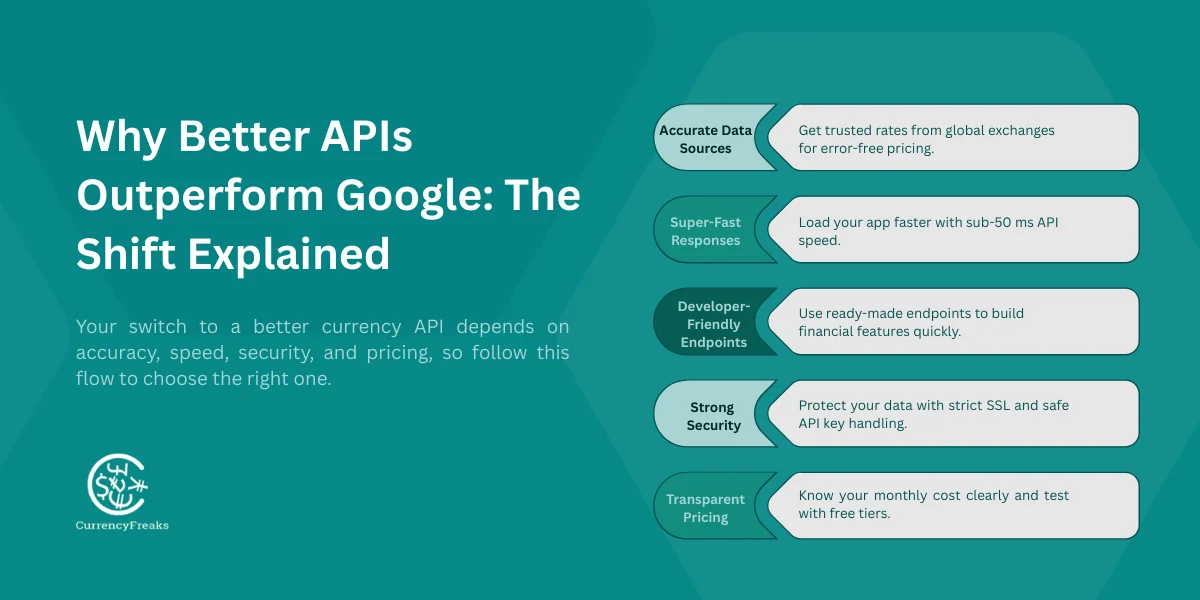

Why Better APIs Outperform Google: The Shift Explained

1. Accuracy and Trusted Data Sources

Modern forex APIs use verified data from global forex exchanges, central banks, and crypto markets. That improves accuracy. It also ensures consistency for financial reports, trading apps, and automated pricing engines.

2. Faster Response Times

Speed matters a lot. Fintech platforms, analytics dashboards, and SaaS tools rely on low latency. A delay creates a bad user experience. Better APIs offer global routing and sub-50 ms responses. That’s a major improvement for developers building fast interfaces.

If you want to learn about currency conversion web services, then read this blog of CurrencyFreaks, the Best Web Service for Currency Conversion.

3. Rich Endpoints Developers Need

Today’s apps need more than just the latest rates. They need:

-

They need live exchange rates

-

They need historical data

-

They need a Time series

-

They need Currency fluctuations

-

They need Base currency switching

-

They need Filters for selected currencies

These endpoints reduce development time. They simplify backend logic. They also help in building accurate financial calculations.

4. Better Security and SSL Enforcement

Best Google currency exchange rate API requests plans enforce SSL on all types of plans. They also give you safer API key handling and authentication for the enterprise. This takes care of sensitive data. It also ensures regulatory compliance for banks and fintech startups.

5. Predictable and Affordable Pricing

Google Currency Exchange rate API does not offer transparent monthly plans. On the other hand, modern APIs offer transparent monthly plans. You will get clear usage limits, and you also get free Google currency exchange rate API tiers for testing. This thing helps developers experiment on their projects without worrying about cost.

If you want to learn about Golang Currency, then read this blog of CurrencyFreaks, Mastering Golang Currency.

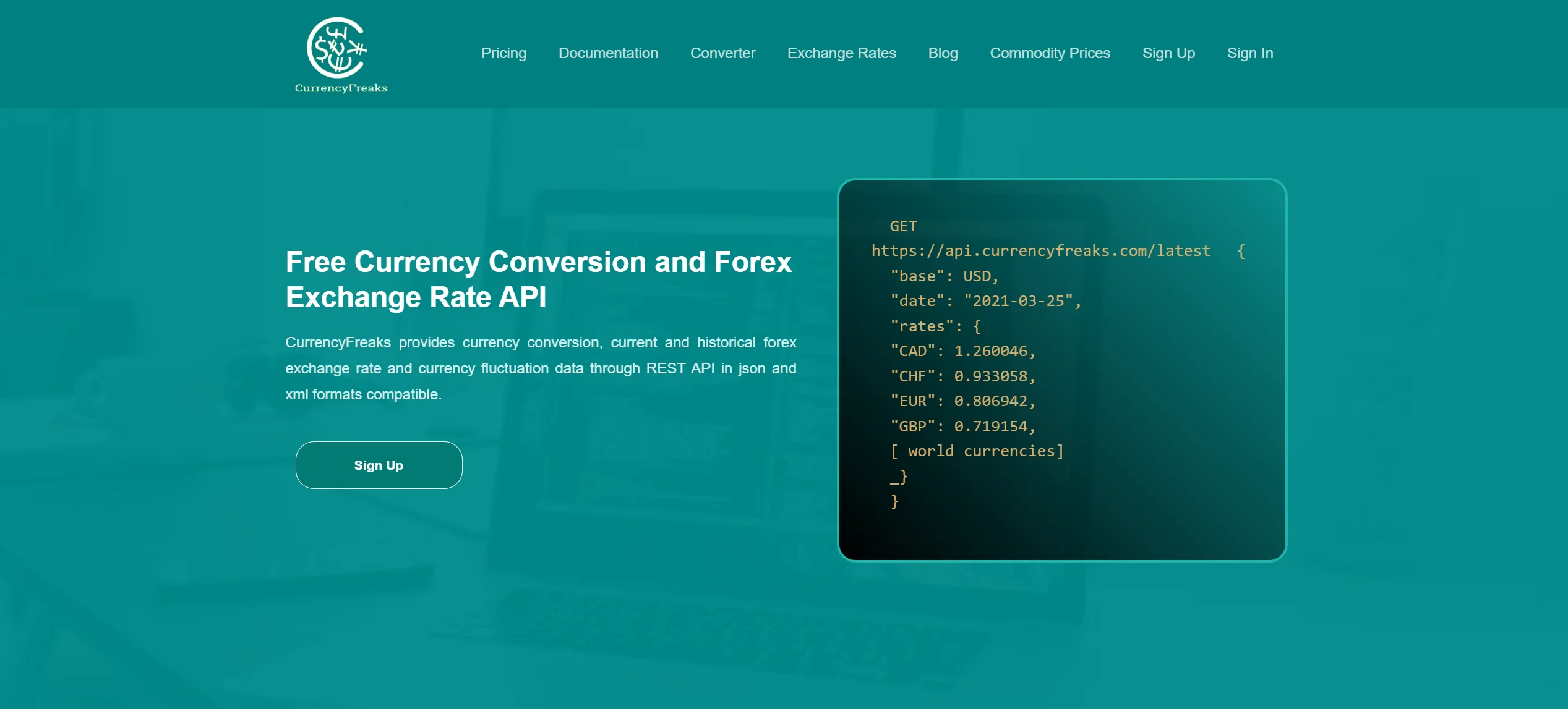

Why CurrencyFreaks Is a Strong Alternative to Google’s API

1. Coverage of World Currencies (Fiat + Crypto + Metals)

You get fiat currencies, precious metals, and crypto assets straight from the European Central Bank. The system updates every minute. This makes CurrencyFreaks ideal for crypto apps, trading tools, and multi-currency platforms.

2. Real-Time, Historical, and Time Series Data

You get decades of historical data. You get a time series for trend analysis. You also get fluctuation reports for daily FX insights. Google Currency Exchange API doesn’t offer any of this.

3. Extremely Fast Speeds With Global Routing

CurrencyFreaks uses geolocation routing. You get a 20-40 ms response time globally. That makes it perfect for high-traffic applications.

4. SSL Encryption on All Plans

In the free plan, the SSL is included. You can use the Google currency exchange rate API in production without worrying about insecure traffic.

5. Easy, Developer-Friendly Documentation

Developers love clear instructions. CurrencyFreaks provides examples for Java, Python, PHP, JavaScript, Ruby, and Swift. You also get complete endpoint breakdowns and sample responses.

6. Flexible Pricing Plans for All Teams

- Developer, Free/Month

In the developer plan, you will get 1,000 calls, SSL, USD base, and updates every 24 hours.

- Starter, $9.99/Month

In the starter plan, you will get 15K calls, hourly updates, historical rates, and conversions.

- Growth, $49.99/Month

In growth, you will get 150K calls, updates in 10 minutes, and IP-to-currency.

- Professional, $99.99/Month

In the professional plan, you will get 550K calls, updates every 60 seconds, and time series + fluctuations.

- Enterprise

In the enterprise, you will receive custom volume and premium support.

These plans scale with your project.

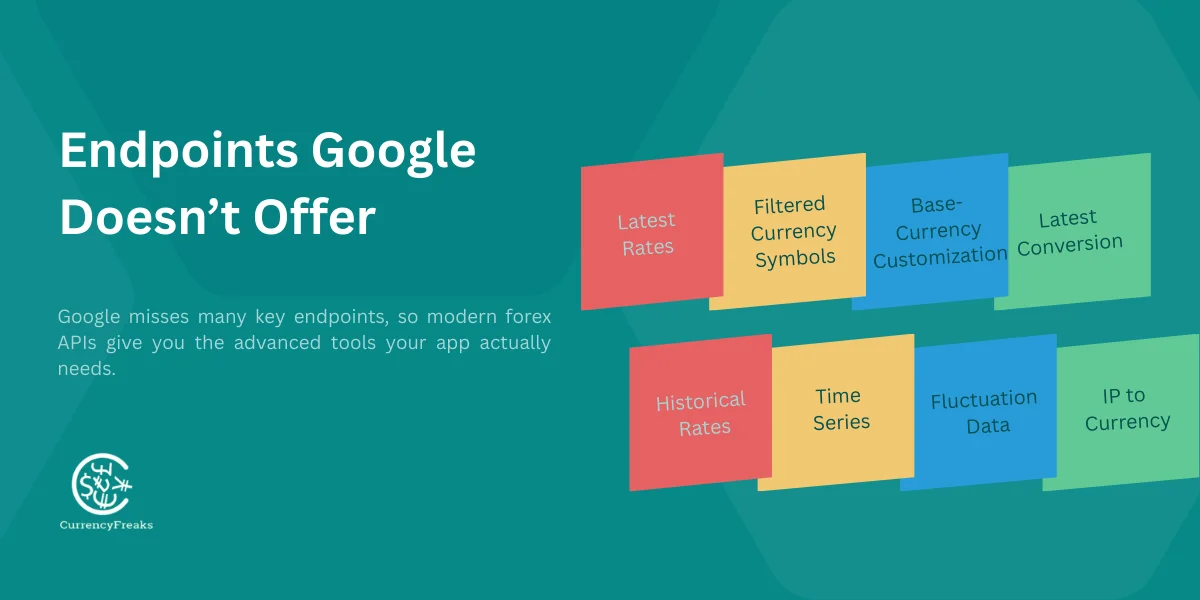

7. Endpoints Google Doesn't Offer

-

They do not offer the Current Exchange Rates

-

Filtered Currency Symbols

-

Base-Currency Customization

-

Latest Conversion

-

Historical Rates

-

Time Series

-

Fluctuation Data

-

IP to Currency

These cover almost every forex use case.

8. Trusted by Global Companies

HP, UGA, Gartner, Exigo, Savart, Timify, and Oodles rely on CurrencyFreaks for high-scale FX operations. This shows how stable the CurrencyFreaks exchange rate API is for enterprise workloads.

Feature-by-Feature Comparison: Google API vs CurrencyFreaks

| Feature | Google API | CurrencyFreaks API |

|---|---|---|

| Real-Time Rates | It has a limited Currency Exchange Rate API Google | Yes (1-minute updates) |

| Historical Data | No Google API | Yes |

| Time Series | No Google API | Yes |

| Fluctuations | No Google API | Yes |

| Conversion Endpoint | No Google API | Yes |

| Supported Currencies | It has a limited Google API | 997 currencies |

| Pricing | Not transparent | Clear plans |

| Free Tier | No official | Yes |

| SSL on All Plans | No | Yes |

| Developer Docs | It has the Basic Google API | Detailed with examples |

When Should Businesses Switch?

1. Scaling Beyond Simple Conversions

If you run eCommerce, SaaS platforms, booking apps, payroll systems, or billing tools, you need real-time accuracy. Google won’t provide it.

2. Need for Accurate FX Insights

Banks, analysts, and algorithmic traders require deep historical and real-time FX data. Time series and fluctuations are essential.

3. Global Products With Live Currency Needs

Crypto wallets, multi-currency apps, and cross-border platforms depend on reliable minute-by-minute updates.

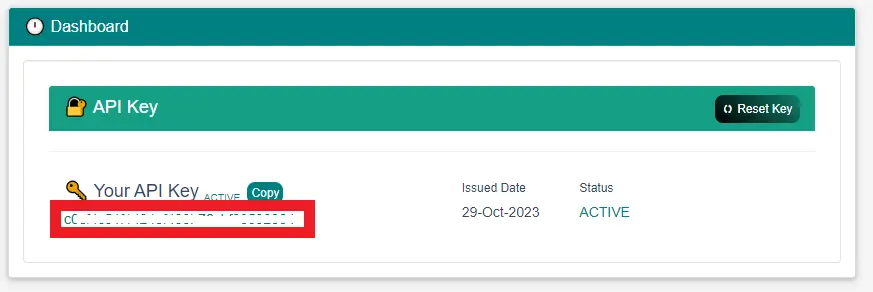

How Easy Is It to Switch From Google’s API?

Step 1: Sign Up and Get API Key

First, create a free account and go to the CurrencyFreaks API dashboard.

Then sign up with your Google account or email.

After signing up, you will immediately get your API key. Do not share your API key with anyone.

Step 2: Replace Endpoints

- Swap your Google endpoints with CurrencyFreaks equivalents.

https://google.com.api.rates

Then add your api key.

$ curl 'https://api.currencyfreaks.com/v2.0/rates/latest?apikey=YOUR_APIKEY'

- Add base currency parameters.

For base currency only write.

?base=USD

Then add your api key.

https://api.currencyfreaks.com/v2.0/rates/latest?apikey=YOUR_KEY&base=EUR

After adding this, all your responses come in converted amounts in your target currency.

- Do not calculate it manually. Use CurrencyFreaks' ready-made endpoints.

https://api.currencyfreaks.com/v2.0/converter?apikey=YOUR_KEY&from=USD&to=PKR&amount=10

Step 3: Test With the Free Plan

Use sandbox tests. Then, validate JSON response or XML responses. After that, check rate accuracy and latency.

Here is your API key.

$ curl 'https://api.currencyfreaks.com/v2.0/rates/latest?apikey=YOUR_APIKEY'

Here is an example of a JSON response:

{

"date": "2023-03-21 12:43:00+00",

"base": "USD",

"rates": {

"AGLD": "2.3263929277654998",

"FJD": "2.21592",

"MXN": "18.670707655673546",

"LVL": "0.651918",

"SCR": "13.21713243157135",

"CDF": "2068.490771",

"BBD": "2.0",

"HNL": "24.57644632001569",

.

.

.

}

}

XML Format

You can get an API response in XML format by following this way:

Pass format=xml as a URL parameter.

Here is your API for XML

$ curl 'https://api.currencyfreaks.com/v2.0/rates/latest?apikey=YOUR_APIKEY&format=xml'

Here is an example of an XML response:

<LatestRatesResponse>

<date>2023-03-21 12:47:00+00</date>

<base>USD</base>

<rates>

<AGLD>2.3150827642088205</AGLD>

<FJD>2.2159199998194876</FJD>

<MXN>18.668821666666666</MXN>

<LVL>0.651985</LVL>

<SCR>13.217309</SCR>

<CDF>2068.359300493814</CDF>

<BBD>2.0</BBD>

<HNL>24.576748999999996</HNL>

.

<_1INCH>1.9102196752626552</_1INCH>

.

.

.

</rates>

</LatestRatesResponse>

If you don't set a format in the URL parameter, the API will respond in JSON format.

Real Example Use Cases

1. eCommerce Platforms

It can update product prices automatically. Reduces the manual conversions. It improves your global pricing strategy.

2. Fintech Apps

It displays the live rates and converts currencies instantly. It powers user dashboards with fast data.

3. Accounting and Billing Platforms

It fetches specific-day rates. It generates accurate invoices and financial reports.

4. Crypto/FX Trading Tools

It uses sub-minute accuracy for charts and algorithms.

Conclusion

Google’s API cannot meet modern currency data requirements. Businesses now want accuracy, speed, transparency, and real developer support. APIs like CurrencyFreaks deliver all of these features. They also give you reliable endpoints for every FX use case. So the shift is natural.

Teams want stability, and they want clear pricing. They want real-time updates. Google does not offer these capabilities. CurrencyFreaks comes in and fills those gaps. It supports 997 currencies and gives you real-time, historical, and time series insights. With you can integrate fast and scale without fear.

FAQs

Why is the Google Currency Exchange Rate API unreliable for businesses?

Google does not give real-time accuracy, historical coverage, advanced endpoints, or transparent pricing.

What is the best alternative to the Google exchange rate API?

CurrencyFreaks is a good alternative. Why? Because it offers more accurate data, more endpoints, and better developer support.

Does Google offer historical FX data?

No, for that, you must switch to an API that provides decades of historical coverage.

Can I get live crypto rates using Google?

No. CurrencyFreaks supports cryptocurrencies.

Is CurrencyFreaks free to use?

Yes, the free services include SSL and 1,000 API calls.