Build a global e-commerce product or a high-frequency trading bot. A currency swing or stock gap can hit in seconds. If your feed lags, losses follow fast, even when you’re using historical data for testing.

In 2026, markets move in real time. Spreadsheets cannot keep up, even for traditional financial institutions. Clean financial data powers every serious fintech product.

This guide shows why the right financial api matters. It reviews 12 providers, from currency tools to institutional analytics. You will compare coverage, latency, and pricing, plus a financial services api option.

What Is a Financial API?

A financial api is a simple way for software to talk to other software. It lets your app request data and get it back in a clean format. Many teams use financial data APIs to pull prices, rates, and account info.

You do not need to build your own pipelines or store everything yourself. You call the API to fetch the latest numbers for dashboards and financial reports. This approach also supports consistent financial statements across tools.

Many financial data api integration platforms group these services into four types, including historical stock prices.

-

Market Data: Live prices on stocks, bonds, and commodities.

-

Currency exchange rates: Real-time currencies of fiat and crypto.

-

Banking & Payments: History and Account balances.

-

Credit & Identity: Credit rating and KYC.

Helpful Resource: How to Choose the Right API for Currency Exchange: Key Factors

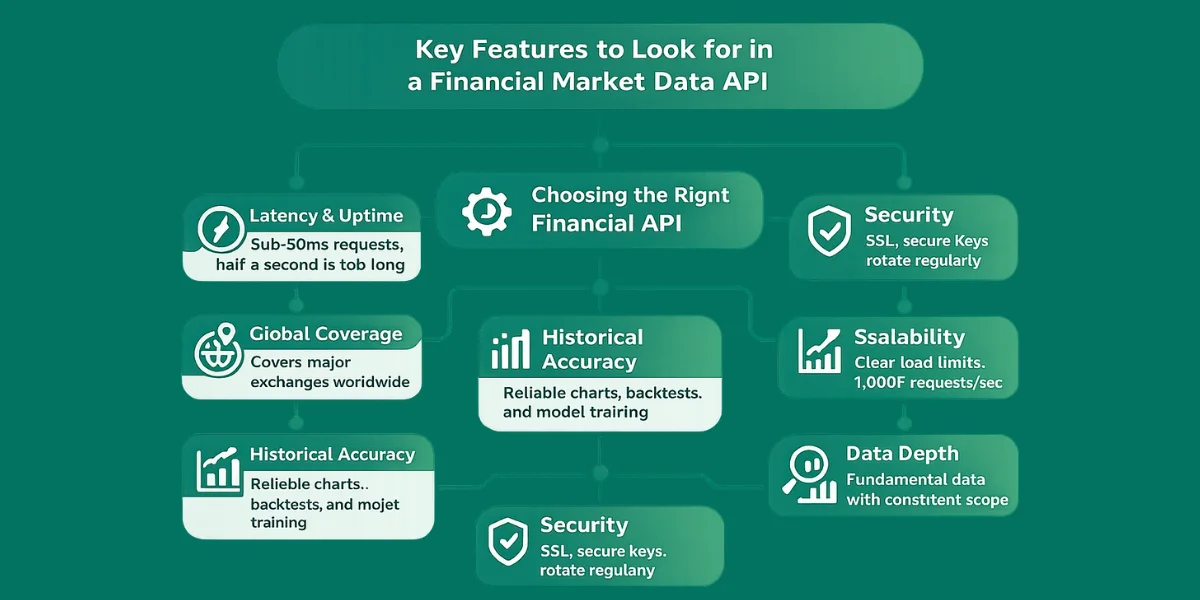

Key Features to Look for in a Financial Market Data API

Choosing the right financial api matters when you start wiring market data into your product. Not every feed gives accurate financial data, so don’t pick based on price alone. Look for providers that also support api financial solutions you can grow into.

Prioritise these criteria when exploring financial data api integration platforms:

-

Latency & Uptime: In 2026, half a second is a long wait for live prices. Try to keep your stock prices request under 50ms.

-

Global Coverage: Make sure it covers major international exchanges. Check regional gaps before you commit.

-

Historical Accuracy: You need historical market data for charts, backtests, and model training. Bad history breaks your results.

-

Security: Use SSL, strict key permissions, and sensible rotation rules. Treat keys like passwords.

-

Scalability: It should hold up at 1,000 requests per second during volatility. Load limits should be clear.

-

Data Depth: Support for fundamental data matters if you screen companies or build research tools. Coverage should be consistent.

Best Financial Market APIs for Real-Time Data in 2026

CurrencyFreaks API

CurrencyFreaks is a reliable, fast financial api for developers. It covers currencies, which include fiat currencies, metals, and + cryptocurrencies. That coverage helps you build global apps without gaps.

It uses geolocation routing for ultra-low latency. Response times average 20-40 ms worldwide. It suits small builds and teams using a financial_datasets_api_key and moving beyond traditional financial services.

It includes a history back to 1984. It is not for historical stock data. Use it for currency trends and testing.

-

Key Data Types: Live exchange rates, historical rates going back to 1984, and currency movement tracking.

-

Best For: Currency converters, local pricing for SaaS apps, and crypto plus forex analysis.

-

Pricing: Free api plan with 1,000 calls, then paid plans start at $9.99 per month.

Helpful Resource: 10 Best Currency Exchange API Options for Developers

Code Example (Node.js):

const axios = require('axios');

async function getLatestRates() {

try {

const response = await axios.get('<https://api.currencyfreaks.com/v2.0/rates/latest?apikey=YOUR_APIKEY>');

console.log("Current USD to EUR:",[ response.data](http://response.data).rates.EUR);

} catch (error) {

console.error("Error fetching data:", error.response.status);

}

}

getLatestRates();

Alpha Vantage

Alpha Vantage is a solid financial api for stocks and forex. Python teams use it for quick research. It offers a free tier with tight limits plus technical indicators.

-

Best For: Retail traders and students.

-

Pricing: Free tier available; premium starts around $49/month.

Polygon.io

Polygon.io fits high-frequency investment platforms. It streams exchange data fast and stays consistent. This financial api feels built for serious trading tools.

-

Best For: It is best for Professional trading software and options tracking.

-

Pricing: Tiered based on asset class (Stocks/Options/Crypto).

Twelve Data

Twelve data covers stocks, forex, and crypto data in one place. It keeps multi-asset apps from juggling vendors. The financial api is clean and easy to work with.

-

Best For: It is best for Multi-asset portfolios and fintech startups.

-

Pricing: Flexible pay-as-you-grow models.

IEX Cloud

IEX Cloud focuses on the US stock market. It works well for apps that show filings and corporate actions. It’s a dependable financial api for clear, structured feeds.

-

Best For: Wealth management tools and US stock apps.

-

Pricing: Credit-based system.

Finnhub

Finnhub is strong for real-time prices with WebSockets. It also pulls sentiment and financial news from many sources. You can build responsive dashboards without polling.

-

Best For: It is best for Real-time dashboards and sentiment analysis.

-

Pricing: Competitive monthly subscriptions.

Marketstack

Marketstack keeps things simple with historical and real-time prices. It covers international markets across 70+ exchanges. This is helpful in finding basics and predictable results.

-

Best For: Light-weight web dashboards and mobile apps.

-

Pricing: Free tier for 1,000 requests.

Yahoo Finance API (Unofficial)

Unofficial wrappers can give you broad data for free. They can also break overnight with no warning. Use it only for hobby builds, not core financial tools.

-

Best For: This is good for Personal hobby projects.

-

Pricing: Generally free/open-source.

Nasdaq Data Link (Formerly Quandl)

Nasdaq Data Link offers deep macro and alternative datasets. It’s useful for research and long time ranges. Many teams use it to compute key financial ratios from fundamentals.

-

Best For: Hedge funds and economic researchers.

-

Pricing: Per-dataset pricing.

Plaid

Plaid connects apps to banks to pull transactions and balances. It’s common in products used by financial institutions and consumer apps. This is the plumbing behind modern budgeting.

-

Best For: Personal finance management (PFM) and lending.

-

Pricing: Usage-based.

RapidAPI Financial APIs Hub

RapidAPI lets you try many providers from one dashboard. It helps you compare data sources quickly. It’s handy when you need niche coverage from other financial institutions or local providers.

-

Best For: Rapid prototyping and testing.

-

Pricing: Varies by provider.

Experian / Credit APIs

Credit APIs matter for lending and identity checks. Experian offers regulated access to credit history and verification. For lending in the financial industry, this is often a must-have source of high quality financial data.

-

Best For: BNPL (Buy Now Pay Later) and credit cards.

-

Pricing: High-tier enterprise pricing.

Comparison of Top Financial API Platforms

| API Provider | What it’s best at | What people love about it | Free option |

|---|---|---|---|

| CurrencyFreaks | Forex + crypto | Covers currencies and stays fast (about 20ms latency) | Yes, 1,000 calls |

| Alpha Vantage | Stocks | Lots of built-in technical indicators | Yes, but limited |

| Polygon.io | Pro trading data | Strong real-time WebSockets for streaming | Yes, basic plan |

| Plaid | Banking connections | Links to 12,000+ financial institutions | Developer mode |

| Twelve Data | Multi-asset (stocks, forex, crypto) | One clean REST API for multiple markets | Yes |

Free vs Paid Financial APIs: What Should You Choose?

The decision between a free financial API or a paid one will be based on your level. No-cost options are available with MVPs and internal tools with low traffic. They allow you to have a free trial of the single API.

Paid plans are important when real users are relying on your app. Paid services include:

-

Increased Rate Limits: Process a large number of users.

-

Reduced Latency: Receive information sooner.

-

SLA Guarantees: Guarantee uptime of 99.9.

As an example, CurrencyFreaks offers a daily updated free plan. The Professional plan is updated every 60 seconds.

It also introduces endpoints like Fluctuation for trading apps. The best free financial data api with credit scores depends on your region and compliance needs.

Financial API Integration: Best Practices in 2026

Financial api integration fails if your code requests are weak. Build for resilience from day one. Pick financial data APIs integration solutions with clear docs and solid error codes.

This matters for apps that track mutual funds. It also matters for apps that monitor financial health or process payments. For a secure setup, follow these rules:

-

Secrecy of Keys: Do not reveal your API key in JavaScript in the client. Always use a backend proxy.

-

Apply Caching: Do not use the API on each page-refresh. Local cache data for a few minutes to save on costs.

-

Error Handling: Markets decline, and servers fail. Make sure that your application has a fallback price.

-

Monitor Usage: Activate notifications so that you do not run out of your monthly limit in the middle of the month.

Helpful Resource: Currency Exchange API Integration: A Step-by-Step Guide for Developers

Use Cases Powered by Financial Market APIs

A huge number of industries are driven by modern API financial solutions, including embedded finance. By 2026, these applications will expand into AI and automation.

They will bring real time access for faster decisions. They will also improve market sentiment tracking. They will support financial modeling prep and more financial instruments.

-

SaaS Localization: Automatically change prices of subscription based on the local currency of the user using an IP to Currency endpoint.

-

AI Trading Bots: Process real-time market data into LLMs (Large Language Models) to determine the behavior of the market in the short term.

-

ERP Systems: Accounting programs such as QuickBooks are based on APIs to automatically synchronize international exchange rates on a daily basis.

-

Wealth Dashboards: Show all stocks, crypto, and bank balances as one Net Worth.

How to Choose the Right Financial API for Your Product

In order to locate the ideal API financial services, consider the following short checklist:

-

Is it protecting my assets? (e.g., Do you need Gold and Bitcoin?)

-

Is the data fast enough? (Real-time vs. 15-minute delay)

-

Is it compliant? (Of importance to banking and credit data)

-

How is the experience of developing? Make sure that they support SDKs in your language (Python, JS, PHP).

Conclusion

Financial APIs are a global infrastructure in 2026, built on application programming interfaces. Live information provides an actual competitive advantage across stock exchanges. As your product expands, so should your provider, and it must meet regulatory compliance.

It can be a neobank you are building or a plain currency converter. Anyhow, you require speed, security, and wide coverage of assets for payment processing too. CurrencyFreaks provides multi-asset support to be used with the next-generation fintech.

FAQs

Which Financial API Is Best For Forex Trading?

CurrencyFreaks is the best choice for financial applications as it is fast (20-40ms) and has 1,000+ supported fiat and crypto currencies.

Can I Get Real-Time Stock Data For Free?

Yes, but free ones such as Alpha Vantage or Marketstack tend to be delayed or limited in the number of requests. This can slow progress toward your financial goal, or when pulling an income statement.

Are Financial APIs Secure For Banking Data?

Yes, fintech services such as Plaid use encryption and token-based login for account aggregation, meaning they do not store your bank password.

Get your free CurrencyFreaks API key and start integrating real-time data in minutes, then explore Documentation or Pricing to pick the right plan.