Imagine Bitcoin listed at $50,000 on a US exchange while a European platform shows it at €47,000. At first glance, it looks like easy money through currency exchange differences. But without the exact real-time EUR to USD rate from a reliable currency api, that gap can disappear fast.

This is where a reliable checker makes the difference. Using a restful api for currency exchange, you can normalize prices using trusted data from sources like the European Central Bank.

In this guide, we walk through the logic, system setup, and why Java works well for building an automated tool that spots real arbitrage instead of false signals.

Why Currency Exchange Matters In Crypto Arbitrage

Crypto arbitrage is the practice of buying an asset on one exchange and selling it on another. You get profit from the price difference. It seems to be simple, but the market shifts really fast.

Prices differ across exchanges due to varying liquidity and regional demand. Many beginners miss how fiat prices move in historical exchange rate data. Those small moves can quietly change the numbers during currency conversion.

Real-time exchange rates act as the hidden glue in arbitrage and keep comparisons consistent. They help you match prices correctly and validate results using historical data when needed. A RESTful API for Currency Exchange delivers accurate exchange rates so your margins stay protected.

Understanding The Basics: Fiat Vs Crypto Pricing

In trading, "quote currencies" are what you pay to buy an asset. These usually include major currencies like USD, EUR, and GBP. Many traders rely on stablecoins such as USDT to keep pricing simple.

Comparing prices without conversion creates false signals and bad decisions. If BTC shows $60,000 and £48,000, the difference means nothing without exchange rate data. You need accurate currency exchange rates to compare values on a single base.

Many trades fail because FX numbers do not match across platforms. Clean signals depend on reliable currency data pulled using an api key. Normalizing prices across markets reveals the real spread and trading edge.

What Is A Real-Time Currency Exchange API?

A Forex API helps you track currency exchange rates as they change in real time. It does not place trades or manage positions for you. Instead, it delivers spot exchange rate data through code for all supported currencies.

Static rates come from historical exchange rates and are already outdated. Delayed prices are risky because markets move fast. Real value comes from rates that reflect what is happening at that exact second.

Developers use APIs like CurrencyFreaks because manual tracking does not scale. These tools pull data influenced by central banks while avoiding hidden fees in raw pricing. These apps must refresh often to keep their numbers right.

How A RESTful Forex API Fits Into An Arbitrage System

Your arbitrage checker works like a central hub. It pulls prices from crypto exchange APIs and tracks multiple currency pairs at once. Many teams start this setup on a free plan before scaling further.

Next, the system calls an exchange rates api to convert currencies correctly. This api integration applies live rates across the full pricing pipeline. It helps show clear, fair price comparisons across markets.

A forex REST API creates a clean normalization layer. It converts everything into one base currency, like USD. This keeps everything consistent across the system.

The insights you get often turn into product management feature requests. Those ideas are usually discussed in a quarterly briefing call.

Important Clarification: Can CurrencyFreaks Be Used For Arbitrage?

It is vital to understand what your tools can and cannot do. Transparency leads to better engineering. You must use the right tool for the right job.

What CurrencyFreaks Can Do

CurrencyFreaks provides real-time currency exchange rates for over 177 fiat currencies. It acts as a reliable normalization layer for your data.

What CurrencyFreaks Does Not Do

It does NOT provide crypto prices or analyze exchange order books. It will not execute trades or detect arbitrage gaps on its own.

The Correct Way To Use CurrencyFreaks In Arbitrage

Use dedicated crypto APIs for the coin prices. Use CurrencyFreaks for the real-time currency conversion. Combine them to ensure your math is 100% correct.

Designing A Beginner-Friendly Crypto Arbitrage Checker

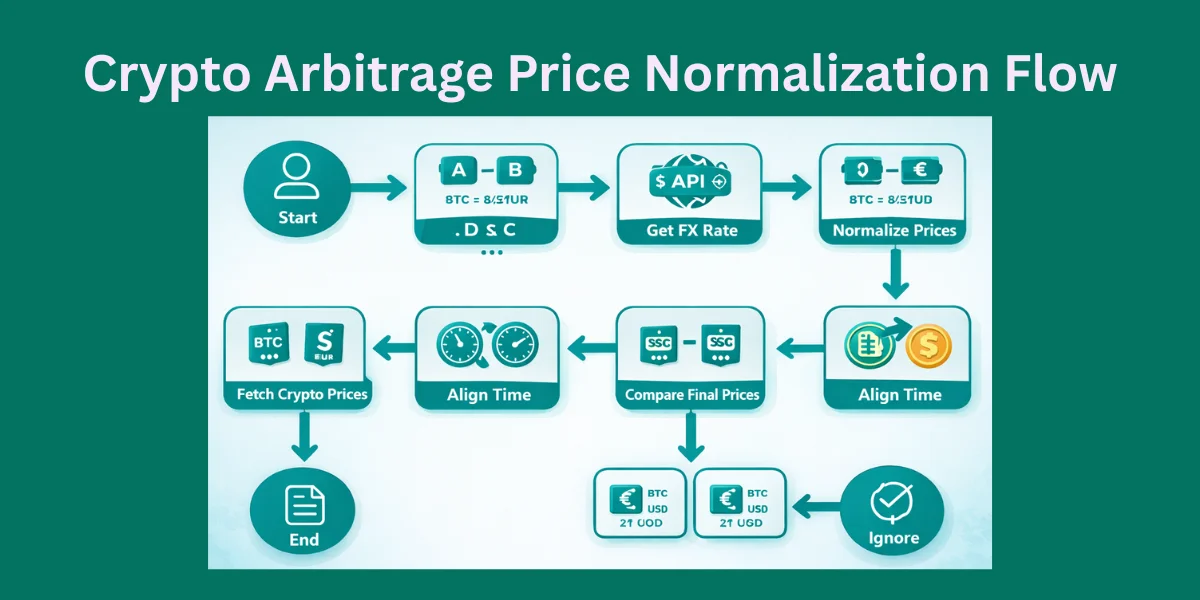

The logic follows a clean, four-step process at a professional level. Start by fetching prices from Exchange A in USD and Exchange B in EUR using api requests. An easy to use api helps avoid hidden fees and keeps calculations predictable.

Next, call the API to get the current EUR/USD rate with hourly updates. Use this rate to line up prices across markets, even for precious metals. It keeps the numbers consistent. That way, comparisons stay clean and easy to trust.

Small FX errors can wipe out margins fast, especially on a paid plan with annual billing. Real-time rates reduce risk and support accurate spreads. Advanced users also benefit from priority roadmap input when scaling volume.

Handling Real-Time Exchange Rates Correctly

Update frequency matters more than it seems. Refresh too slowly, and your currency rates fall behind the market. Refresh too fast, and a simple rest api may hit limits on supported api endpoints.

Use a caching strategy that fits market conditions. Cache FX data for a few seconds when prices are calm. This reduces load and works well with what the api supports today.

Always line up your timestamps across data sources. Make sure crypto prices and currency rates share the same moment. This avoids phantom arbitrage and reduces noisy feature requests from traders.

Scaling Considerations For Arbitrage And Price Monitoring

Update frequency matters more than it seems. Refresh too slowly, and your rates drift away from the market. Refresh too fast, and even a solid rest api like the fixer api can hit limits on supported endpoints.

Use a caching strategy that fits market conditions. Cache FX data for a few seconds when the market is calm. It reduces system load. It also makes effortless integration easier across different programming languages.

Always line up timestamps across all data sources. Crypto prices and currency rates must reflect the same moment. For commercial use, tools like Platinum Support and Platinum Support Click help reduce phantom arbitrage and cut noisy feature requests from traders.

Comparing Data Sources

| What it shows | Crypto Exchange API | CurrencyFreaks API |

|---|---|---|

| Main data | Crypto prices like BTC, ETH, and SOL | Currency rates such as USD, EUR, and GBP |

| How fast it updates | Updates in milliseconds | Updates every 60 seconds to 24 hours |

| Why it matters | Finds the live crypto price | Brings all prices to the same currency base |

Code Example: Building A Simple Crypto Arbitrage Checker

This Java example shows how to normalize a price using a forex Java API. We will fetch a rate and apply it to a crypto price.

Java

// Example Logic for Price Normalization

public class ArbitrageChecker {

public static void main(String[] args) {

double priceInEUR = 47000.00; // From Crypto Exchange

double eurToUsdRate = 1.08; // From CurrencyFreaks API

double normalizedPriceUSD = priceInEUR * eurToUsdRate;

System.out.println("Normalized Price: $" + normalizedPriceUSD);

}

}

This simple logic ensures your comparison is valid. You can expand this by adding HTTP clients. These clients fetch real-time JSON data from the API endpoints.

Why Java Is Commonly Used For Forex And Arbitrage Systems

Java is a heavyweight in the fintech world. It works well for tools that need a real time currency converter running all day. Your checker can stay online 24/7 without crashing.

The JVM offers strong performance for heavy math. It handles multi-threading well, which matters when processing real time foreign exchange rates. This keeps calculations fast and reliable.

Using a forex Java API makes sense for serious trading systems. Python is great for quick tests and prototypes. Java brings the strength you need for real financial execution.

Common Beginner Mistakes In Arbitrage And FX Conversion

Many beginners assume that 1 USDT always equals 1 USD. That is not always true. Stablecoins can drift, and without real time currency exchange rates, small gaps turn into math errors.

Ignoring the FX spread is another common mistake. Banks and APIs price buy and sell a bit differently. Even with forex unlimited plans, those costs still matter and should be counted.

Never mix delayed FX rates with live crypto prices. If crypto is priced now, but you use real time foreign currency exchange rates from an hour ago, the numbers break. That kind of mismatch leads to bad signals and real losses.

Testing And Validating Arbitrage Logic

Good engineering needs real testing, not assumptions. Start by simulating FX changes with real time exchange rates. See how your system responds to a sudden 1% drop in the Euro.

Test edge cases like API timeouts or empty JSON responses. Your system should fail safely when real time currency rates are missing. It should never place a trade because a value came back null.

Run your strategy on historical exchange data first. This helps you understand how it reacts to real time currency exchange conditions over time. An exchange integration api helps you replay real market moves with confidence.

Extending Beyond Arbitrage: Other Use Cases

The power of a currency API goes beyond arbitrage. With a real time currency rates api, you can build crypto price comparison tools for everyday investors. These tools rely on clean currency exchange data to stay useful.

Multi-currency dashboards are very popular. They show total net worth in one currency, even if assets are spread across markets. Premium features often include historical rates. They also support many available currencies.

SaaS pricing engines also depend on these APIs. They display correct prices for global customers. Live exchange updates keep every number accurate and trustworthy.

Conclusion

CurrencyFreaks gives you the infrastructure, and you bring the logic. Think of it as a clean base layer built with intuitive APIs that pull from multiple sources. It fits naturally into product management workflows without getting in the way.

Accurate FX data is not optional. It is required for clarity and trust. Without it, profits become guesses, even if you run a quarterly briefing to review performance.

Build systems with care and intention. Use real-time exchange rates so users can rely on what they see and get clear issue access when something breaks. In crypto, accuracy is the real edge.

FAQs

Can CurrencyFreaks Be Used As A Crypto Arbitrage Engine?

No. CurrencyFreaks is not an arbitrage engine. It does not fetch crypto prices, analyze order books, or execute trades. It serves as a real-time currency exchange rates provider.

Why Do Arbitrage Systems Need A RESTful API For Currency Exchange?

Arbitrage systems compare prices in different currencies. A RESTful API converts those prices in real time. This keeps the math clean and the signals correct.

Is CurrencyFreaks Suitable For Real-Time Currency Conversion?

Yes. It provides live forex rates. You can use them to line up prices, build dashboards, or check for arbitrage.

Does CurrencyFreaks Provide Crypto Prices Like BTC Or ETH?

No. CurrencyFreaks does not show BTC or ETH prices. It only deals with forex and regular currencies. For crypto prices, you will have to pull them from exchanges like Binance or Coinbase.

Can I Use CurrencyFreaks For USDT To USD Conversion?

Yes, but with caution. USDT is a stablecoin. It usually stays close to the US dollar, but it can drift at times. Use CurrencyFreaks for fiat and validate stablecoins separately.

Ready to build your own financial tools?

Sign up for a free CurrencyFreaks API key and start normalizing your data today!