Unsure of which currency API to choose for your app? In today’s global market, having the latest exchange rates is vital for developers with different applications. This blog will help you decide between two popular options: Exchange Rates API and CurrencyFreaks.

We will start by discussing why a currency API is important and what you should consider when selecting it. Then, we will look at the challenges involved in choosing the right API for developers. We will also examine the most prevalent currency APIs in 2024.

Afterward, we’ll have a detailed comparison of CurrencyFreaks and Exchange Rates APIs. Their features, security, pricing, and global coverage are among the topics we’ll delve into here. At the end of this blog post, you can tell which one suits your needs best.

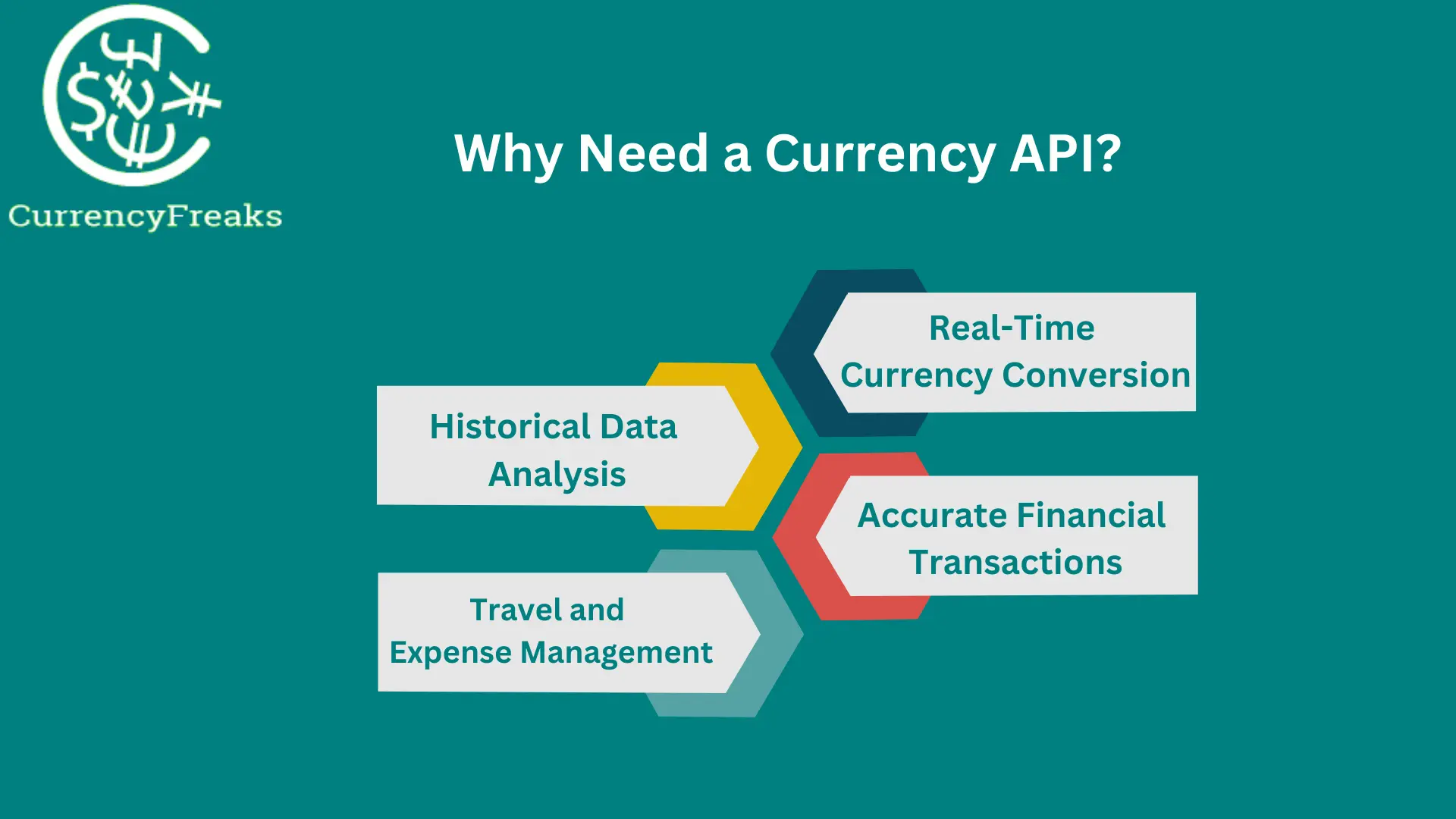

Why Do You Need a Currency API?

Businesses and apps that deal with different currencies find a currency API very useful; here are some reasons why:

Real-Time Currency Conversion

If you run an online store selling products worldwide, a currency API can help. It displays prices automatically in your customer’s local currency. Thereby making shopping easier for them which can improve your sales.

Accurate Financial Transactions

The most up-to-date exchange rates are crucial for banks as well as forex firms. A real-time feed from a currency API enables these organizations to offer competitive rates while minimizing their exposure to loss. For instance, this kind of platform could enable forex traders in making informed choices about their trades based on current trends.

Travel and Expense Management

Currency APIs allow travel applications to convert expenses to traveler's home money when they are abroad. For example, an expense tracking app that converts a business traveler’s expenses into their home currency for easy reporting and reimbursement.

Historical Data Analysis

Businesses can use historical exchange rate data for planning or analysis purposes. A currency API provides access to this information. For instance, an investment firm can use this data to predict market movements and choose better investments.

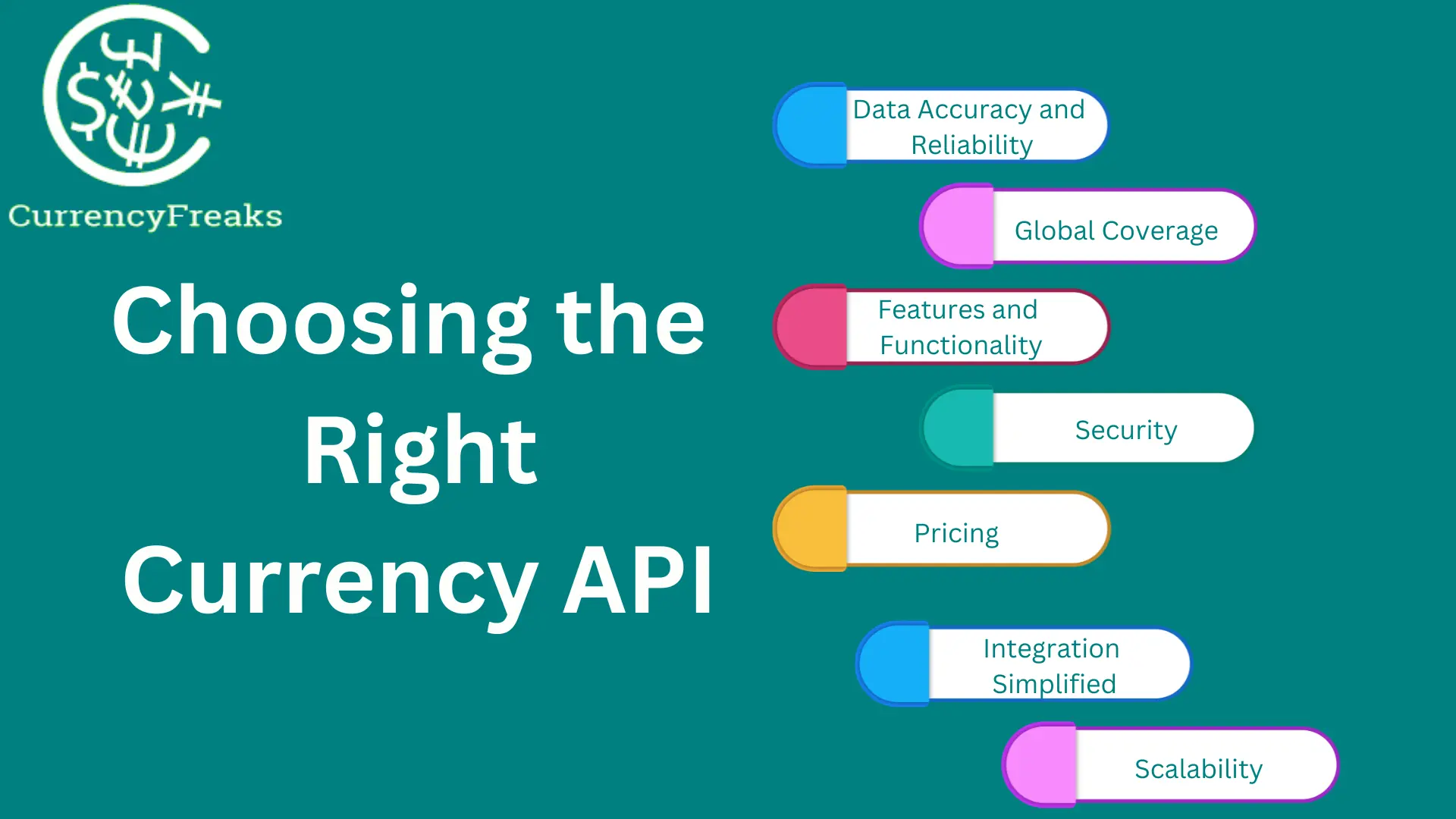

What Factors Do You Consider When Choosing the Right Currency API?

Choosing the right currency API is important for your business. Below are the main factors to consider:

Data Accuracy and Reliability

Ensure that the API gives accurate and up-to-date exchange rates. Check how often the rates are updated. For financial apps, rates updated every minute are essential.

Global Coverage

Check the number of currencies supported by an API. If you deal with many countries, you need an API that covers a wide range of currencies. Some APIs support over 160 currencies which is great for global businesses.

Features and Functionality

Go through the API's features. Common ones include real-time rates, historical data, and currency conversion. Converting a desired currency rate, IP to currency, and time series data might also be advantageous.

Security

Security is very important, especially for financial transactions. Make sure that the API vendor uses SSL encryption and has strong security measures in place. It will help you to protect user data while keeping their information safe.

Pricing

Compare prices of different APIs available in the market today. Some have free plans with basic features while others have paid plans with advanced features. Taking into account your budget, select an API that offers you good value for money.

Integration Simplified

The systems need to integrate easily with the API. You should verify that it has good documentation and support. An application program interface (API) with both a guide for use and helpdesk services can save some time.

Scalability

The API should be able to grow exponentially alongside your business. Because of this, you might require additional tools from the API in the future as your business expands. It should accommodate more data queries and increase web traffic without latency.

What Challenges Developer Can Face When Choosing the Right Currency API?

Developers can encounter several tech challenges when selecting a currency API.

- One major problem is ensuring the data is accurate and up-to-date, as currencies fluctuate frequently.

- Additionally, the API’s speed and performance could affect the user experience of the application in general.

- Compatibility with existing systems should allow for easily integrating the API without making many changes.

- Security matters since financial data has to be safeguarded from breaches.

- Supporting various data formats alongside handling different currencies, including some rare ones, may also become complicated.

- Lastly, the API should be able to expand on user demand without losing its performance level.

Most Popular Currency APIs in 2024

These are the two most famous currency APIs among developers this year:

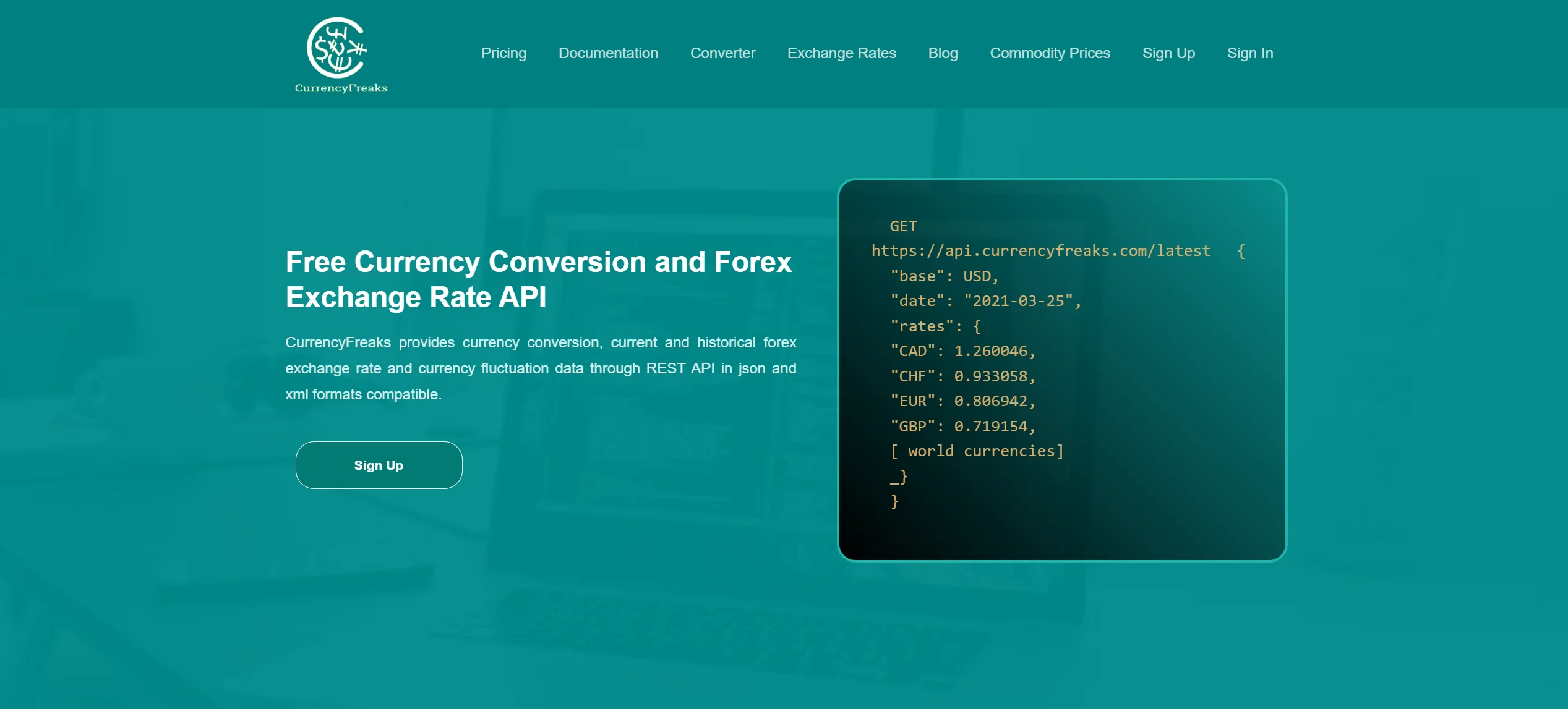

CurrencyFreaks

JFreaks Software Solutions designed CurrencyFreaks. The team is based in Lahore, Pakistan. They have spent three years in software development. Their expertise lies in data analysis and location-based application development.

They thought that there was a need for a simple but reliable and affordable currency API. In response, they launched CurrencyFreaks. It gives updates on global currencies. It consists of fiat currencies, metals, and cryptocurrencies.

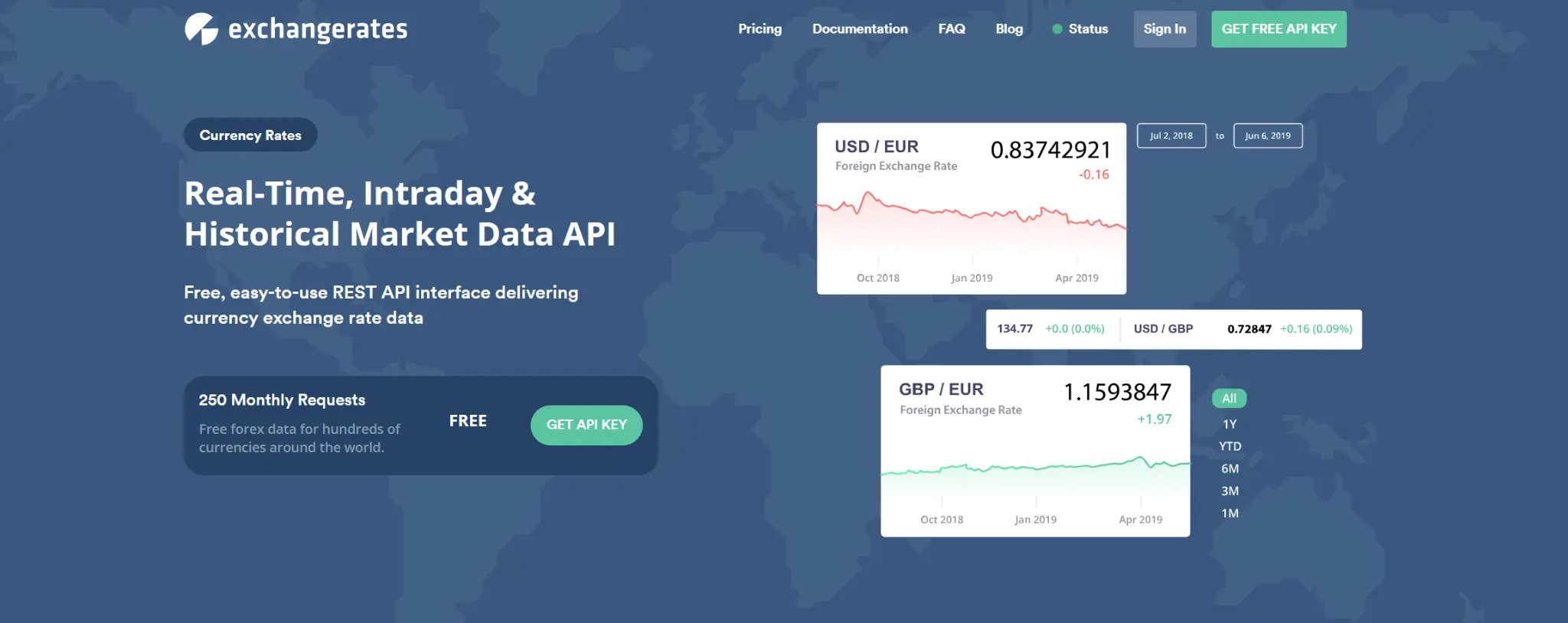

Exchange Rates API

This API provides strong features while being easy for users to operate throughout their sessions, which does not require any payment. A free REST API that gives exact currency exchange rate details within seconds. This service covers several hundred national tender units and refreshes every minute.

Developers can initially make up to two hundred fifty requests within every month for free plus hidden charges are not always applicable.

ExchangeRatesAPI.io guarantees reliability trusted by over one hundred thousand developers worldwide. It provides live data about currency exchange rates that are accurate. Updates happen every minute. It works with over two hundred currency pairs.It offers exact prices from reliable foreign exchange sources.

This scalable infrastructure is able to handle various request volumes from a few requests per day up to thousands per second.The process is easy, fast and it is reliable.

| Features | CurrencyFreaks | Exchange Rates API |

|---|---|---|

| Security | SSL encryption for all plans | SSL encryption for all plans |

| Pricing | $9.99 monthly with Limited Support | Free plan available; paid plans from $10/month |

| Global Coverage | currencies | 200+ currencies |

| Free Plan | 1000 free API calls | 250 free API calls per month |

| Features | 60 Seconds Updates, JSON, XML, Authorization | 60 seconds update, Only JSON format |

| 60 Seconds Updates | ✔️ | ✔️ |

| JSON | ✔️ | ✔️ |

| XML | ✔️ | ❌ |

| Authorization | ✔️ | ✔️ |

| Latest Currency Rates | ✔️ | ✔️ |

| Desired Currencies Rates Only | ✔️ | ✔️ |

| Change Base Currency | ✔️ | ✔️ |

| Historical Rates | ✔️ | ✔️ |

| Latest Rates Conversion | ✔️ | ✔️ |

| Historical Data Limits | ✔️ | ✔️ |

| Supported Currency Symbols | ✔️ | ✔️ |

| Supported Currencies | ✔️ | ✔️ |

| IP To Currency | ✔️ | ❌ |

| Historical Rates Conversion | ✔️ | ✔️ |

| Fluctuation | ✔️ | ✔️ |

| Time Series Endpoint | ✔️ | ✔️ |

| Specify Output Currency | ✔️ | ✔️ |

Conclusion

It’s very important to choose the right API for currency needs. Both Exchange Rates API and CurrencyFreaks have their benefits. It all depends on what you want exactly

Exchange Rates API updates every 60 seconds and supports 200+ currencies. It can handle high request volumes. The free plan includes 250 monthly API calls. It is a cost-effective choice.

CurrencyFreaks covers currencies, including fiat, metals, and cryptocurrencies. The free plan includes 1000 monthly API calls. Their support for JSON or XML format also ensures security using SSL encryption.

Go for CurrencyFreaks if you want greater currency coverage as well as more free calls. Choose Exchange Rates API if the requirement is frequent updates and robust scalability. Determine your needs in order to select the best API for you.

FAQs

What is a Currency API?

A Currency API provides real-time exchange rates and currency conversion data for developers.

Why Are the Benefits of CurrencyFreaks API for Developers?

CurrencyFreaks API offers accurate exchange rates, real-time data, and easy integration for developers.

Which Programming Languages CurrencyFreaks Support?

CurrencyFreaks supports Shell, Node.js, Java, Python, PHP, Ruby, JavaScript, C#, Go, C, and Swift.

How Many Endpoints CurrencyFreaks Support?

CurrencyFreaks supports nine endpoints:

- Latest Currency Rates

- Desired Currencies Rates Only

- Change Base Currency

- Latest Rates Conversion

- Historical Rates

- Time Series

- Fluctuation

- Historical Rates Conversion

- IP To Currency.

Sign Up for free at CurrencyFreaks to use free API requests up to 1000 per month.