Money moves across borders in seconds now. If your app can’t stay in sync with shifting currency values, it quickly loses credibility. A dependable currency API has become essential for modern SaaS products.

Your app needs accurate and reliable data for each and every payment, or even just viewing another currency rate. Even a small delay or wrong rate can break a transaction or damage your brand. Up-to-date currency data helps to keep the fair pricing and smooth operations.

This guide will help you in choosing the best currency API for your SaaS product. This blog is divided into explaining features, performance, security, and pricing. By the end, you’ll have a clear idea of what’s worth choosing.

What Is a Best Currency API?

A best currency API delivers exchange rate data through simple REST endpoints. It connects your app to real-time global currency information. You can request it anytime through HTTP calls.

These APIs support key functions like live conversion, historical data, and market updates. Many also include crypto and precious metal rates in the same system. This is helpful for the apps related to finance, e-commerce, and analytics.

SaaS platforms use currency APIs for pricing, billing, and reporting. They remove the need to manually track rates or upload data. Just integrating currency APIs makes your app work globally.

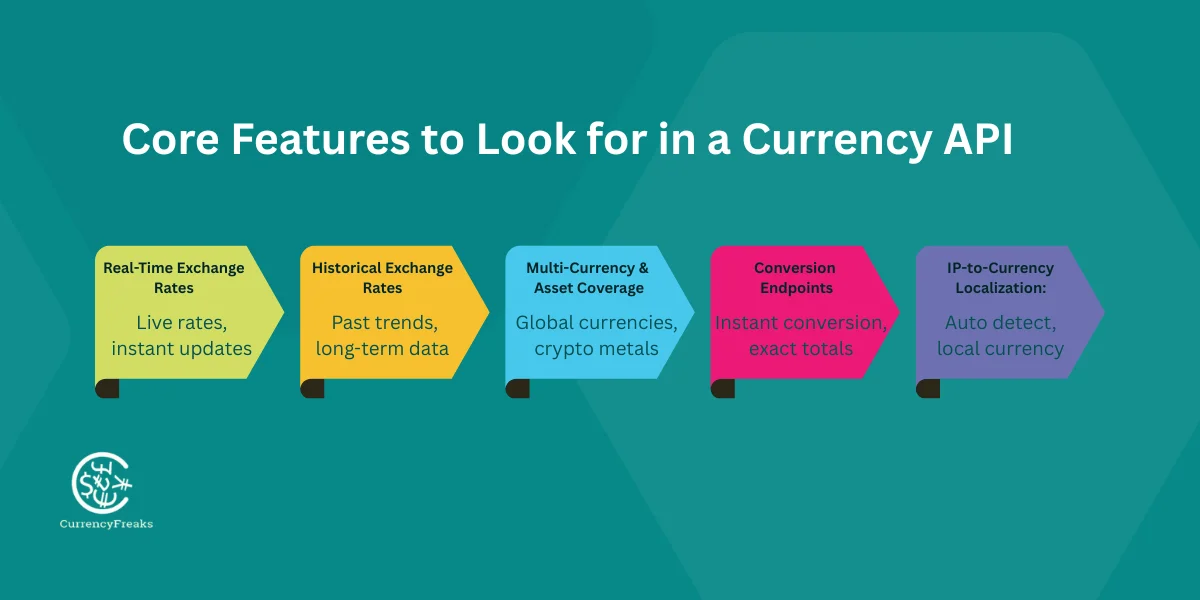

Core Features to Look for in a Best Currency API

Real-Time Currency Exchange Rates

When your rates are up-to-date, your data stays trustworthy, especially when dealing with foreign exchange rates. That’s critical when prices change all the time. Even small timing gaps can create major errors.

Trading platforms, wallets, and payment systems depend on live data. They use fresh rates to calculate totals and confirm transactions. Without this, users lose confidence.

A best currency API updates rates frequently. Some refresh every minute or faster. That level of speed protects both the business and the customer.

Historical Exchange Rates in a Best Currency API

Historical data gives your app a long-term view of exchange rate data. You can track trends, build reports, and run audits safely. It also supports deeper financial analysis.

Developers often need years of past data. That data helps with forecasting, compliance work, and even checking reliable exchange rates over time. CurrencyFreaks, for example, supports historical rates back to 1984.

With this access, businesses can compare past and present values, including cryptocurrency exchange rates. They can also generate accurate financial records and easily convert currencies when needed. This is essential for serious SaaS tools.

Multi-Currency & Asset Coverage

Major world currencies are just the starting point. A solid API also includes rare ones, plus crypto and metals. That kind of range opens your app to the world.

Some APIs fall short on coverage. Others, like CurrencyFreaks, support up to currencies, including cryptocurrencies. That opens doors to international users.

Wider coverage means fewer limitations. Your customers can work in any region or market. Your app becomes more valuable overnight.

Conversion Endpoints

Conversion endpoints allow instant rate calculations. You send two currencies and an amount. The API returns the converted value.

This feature is vital for pricing, checkouts, and invoicing. Users see exact totals in their local currencies. That clarity reduces confusion and friction.

Some APIs also support historical currency conversion. That helps with past invoicing or financial analysis. It gives full control over time-based data.

IP-to-Currency Localization

IP localization detects a visitor’s location instantly. The API then shows rates in their local currency. This feels seamless and personal.

E-commerce and SaaS apps rely on this feature daily. It removes the need for users to pick their currency manually. The system does it for them.

A smooth experience makes people feel confident. It shows you understand them. Even something small can make a big difference.

API Performance and Reliability

Speed matters in currency data. A slow API creates a delay and breaks the user experience. The best services use geolocation routing to keep latency under 50ms worldwide, which is something that often comes up in product management feature requests for performance improvements.

Users won’t care how fast it is if it isn’t there when they need it. Downtime breaks trust and data flow. Always confirm the SLA before you commit.

Rate limits matter more than people realize. Free plans give you only so many requests, while paid ones open the door wider. Understanding this helps you scale without surprises.

Error handling must be clean and informative. A good API returns clear HTTP response codes. This makes debugging simple and efficient.

A reliable API isn’t only about being fast. It also has to get things right every single time. That consistency keeps your SaaS running smoothly.

Security Considerations

Security starts with encrypted connections. A quality exchange rates API uses ssl encryption for all communications, often delivering data in a portable json format. This keeps data protected in transit.

API keys must stay private and secure, especially when working with intuitive apis that offer quick issue access to data. Always store them on the server side. Never expose them in public frontend code.

You also need to think about compliance, especially if you want your platform to scale into limitless opportunities. When payments are involved, standards like GDPR and PCI DSS become important. A secure currency converter API makes compliance easier.

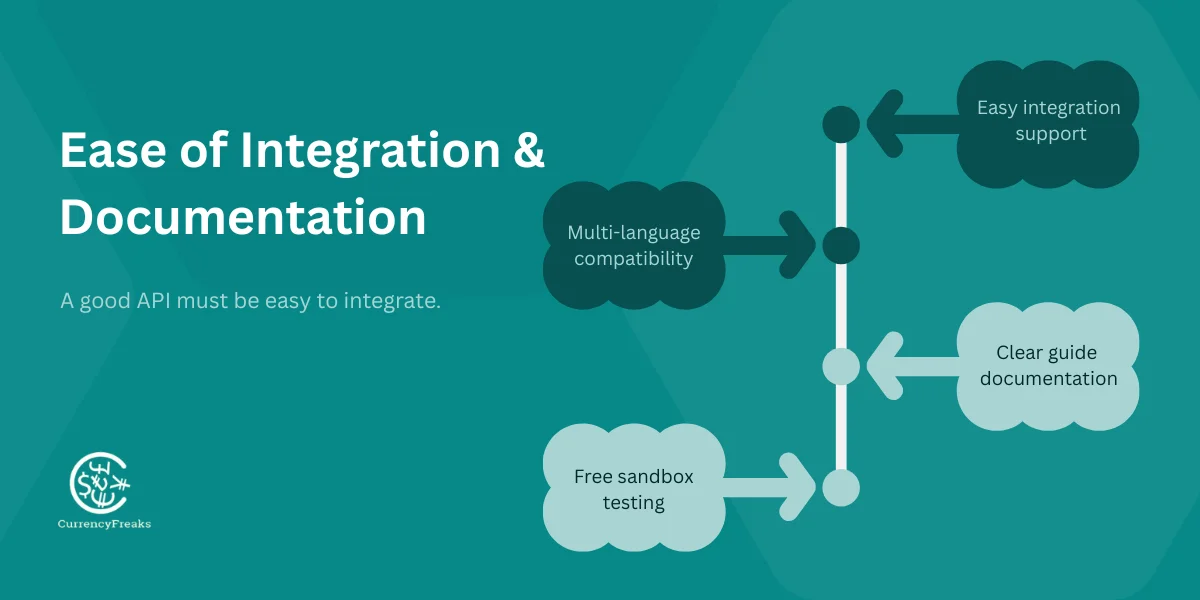

Ease of Integration & Documentation

A good API must be easy to integrate. A reliable JSON API makes this process smoother from the start. Make sure it supports languages like Python, JavaScript, PHP, Ruby, and Swift, especially when adding features to your priority roadmap input. It’ll save you a lot of development time.

Clean, easy-to-read guides make a big difference, supported by extensive documentation. Endpoints for latest rates, history, timeseries, and fluctuations must be well explained, especially when using a currency conversion API for accurate results. That reduces trial and error.

A free or sandbox plan is a big plus when testing api calls and exploring historical foreign exchange data. It allows testing without risk, which makes experimentation easier. So you can test everything before making it live, and feel confident before rolling it out to real users.

Pricing & Plan Structure

Many currency conversion APIs offer free starter plans. These include limited calls, fewer updates, and options like a hidden fees starter, so they are really helpful for testing or small apps that don’t yet need real time exchange rates at scale.

Paid plans unlock higher limits and advanced features, often without hidden fees business, while also delivering more accurate rates. They usually follow tiers like Developer, Starter, Growth, Professional, and Enterprise. Each level supports bigger SaaS needs.

The best choice depends on your usage. Compare price, data depth, and update frequency, and see whether annual billing makes sense for your budget. Choose the plan that fits your real demand.

Comparing Popular Currency APIs

Several currency APIs dominate the market. A few well-known include CurrencyFreaks, Fixer, OANDA, XE, Open Exchange Rates, and Currencylayer API. They all have their own strong points.

CurrencyFreaks sets itself apart with broad coverage and flexible options. It covers far more than just the usual currencies. You’ll also find crypto and even metals in the mix, and there’s plenty of past data to work with, too.

Some competitors offer fewer currencies or charge higher fees. Others limit access to crypto or require premium tiers for basic features. This can restrict growing SaaS startups that need flexibility across multiple currency pairs.

Update frequency also varies across platforms found in any large API marketplace. CurrencyFreaks offers minute-level updates in higher plans. Many others stay limited to hourly refreshes, which can slow down decision-making when you need instant access to data.

Security and support are also critical points. A responsive team and bank level security make a big difference. It’s always smarter to run a few tests before deciding.

Best Practices for Selecting a Currency API

Start by listing your exact needs. Think about call volume, data frequency, and the number of api requests you’ll be making. Especially if your data needs to align with sources like the European Central Bank. Clarity helps you avoid overpaying.

Always test the API before committing to ensure effortless integration. Pay attention to how fast it is, how often it stays up, and how it behaves when something goes wrong. Small tests reveal big issues.

Choose a provider with strong documentation and support, along with access to premium features and coverage across 170 world currencies. Problems will happen, and you’ll need fast help. Good service makes scaling easier.

Conclusion

A strong currency API is the backbone of any global SaaS app, giving you access to trusted sources currency data at all times. It powers pricing, payments, and reports in real time. Without it, accuracy falls apart.

Focus on features, speed, security, and scalability, and look for detailed API documentation and a straightforward API structure that makes things easier from the start. Go with an API that won’t hold you back later. There’s no need to rush.

The right choice will support user trust and smooth expansion, especially if it comes with platinum support click access and a quarterly briefing call to keep you aligned as you scale. Reliable currency data sets your SaaS apart. It’s a quiet tool with massive impact.

FAQs

What Is a Currency API?

A currency API gives programmatic access to exchange rates. It gives you today’s rates and past ones too. This helps your app show data that people can actually trust, in real time.

Do I Need a Currency API for My SaaS App?

Yes, it really matters when your users are working with different currencies. It affects everything from payments to reports and even pricing. A currency API handles it in the background and keeps things right.

Can I Use a Free Currency API for Commercial SaaS?

Yes, you can use free currency APIs for commercial SaaS. But it usually has limited support. They’re good for testing or small projects. Paid plan is a great choice for production.

How Often Are Rates Updated?

Update speed depends on the plan. On the higher plans, CurrencyFreaks updates its rates every minute. Lower plans usually update hourly.

Are Crypto and Metal Rates Supported?

Some providers support them, and some don’t. CurrencyFreaks includes cryptocurrencies and precious metals. This makes it more versatile.